Through Standard Chartered Bank’s enhanced liquidity management platform, Straight2Bank Liquidity, you can enjoy enhanced visibility and control of your liquidity with monitoring, reporting and alerting capabilities. Our sweeping solution also offers a wide range of sweeping parameters and frequencies to meet the operating cash needs of each of your entities.

- Robust intercompany administration with comprehensive interest allocation, posting, settlement and reporting capabilities

- Intercompany limit management to define lending and borrowing limits,required in some locations

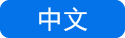

- Solutions that cater to local regulatory requirements such as cost-efficient multi-party entrustment loans and horizontal sweeping structures in China

- Automated sweeping solution to transfer funds from in-country accounts to a designated in-country ‘master’ account

- Automated funding of deficit accounts by master account

- Sweep parameters are fully customisable to meet your needs

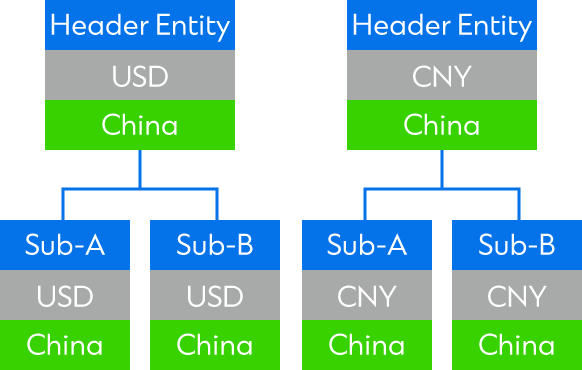

As you expand locally in your key growth markets, you may be establishing several new subsidiaries or opening multiple accounts. It is common in these situations to have pockets of deficit and surplus cash, leading to challenges listed below.

Our local expertise and comprehensive suite of domestic sweeping solutions can help you overcome these challenges and optimise the working capital of your various subsidiaries.

- Arm’s length’s principle on interest applied on intercompany transactions

- Only unencumbered funds can participate in sweeping and interest optimisation

For more information, please contact your relationship manager, transaction banking sales consultant, or visit sc.com/cn

The material is not intended to be distributed to clients incorporated in Australia as a result of regulatory requirements.

It is for information and discussion purposes only and does not constitute an invitation, recommendation or offer to subscribe for or purchase any of the products or services mentioned or to enter into any transaction.

©Copyright 2022 Standard Chartered Bank (China) Limited. All rights reserved. All copyrights subsisting and arising out of these materials belong to Standard Chartered Bank (China) Limited and may not be reproduced, distributed, amended, modified, adapted, transmitted in any form, or translated in any way without the prior written consent of Standard Chartered Bank (China) Limited.